However, you should consistently use one method or the other, or change the Net Pay account to the correct account depending on which method is being used. The method you select is your preference. This method is often used when payroll checks are written from a separate bank account than the regular transaction checks.

The Net Pay account on the Automatic Payroll Posting screen for checks written using this method must be a Cash account.To enter them, press ALT-P, or go directly to the Payroll Data Entry button from the Transaction Data Entry screen without entering anything on the transaction line.The paychecks are kept in a separate payroll journal.This method is used when payroll checks and regular transaction checks are written from the same bank account.Ĭhecks written this way aren't displayed on the Transaction Data Entry screen as a line item along with other transactions.E-method checks must specify an Accrued Payroll account for the background posting to correctly assign debits and credits.If the cash account is assigned for Net Pay with the E-method, then the Cash Account will be credited twice: once as a credit on the Net Pay account assignment, and again as the Cash Disbursement credit to the default bank account.This is due to the way the cash disbursement entry is made as a credit to the default bank account.The Net Pay account on the Automatic Payroll Posting screen should be an accrued liability account.This lets the system know you are writing an Employee check and pulls up the Payroll Data Entry screen.Enter E in the E/V field after entering the check number and the date.Enter the checks directly on the Transaction Data Entry screen.The E-Method:Ĭhecks written this way are displayed on the Transaction Data Entry screen with all of the regular transactions and will be included in Transaction Listing reports: The Net Pay Account is designated differently depending on which method is used for that paycheck, therefore enter the appropriate account number in the Net Pay field. After-the-fact payroll entry in write up: Both are done through the Enter Transactions screen. There are two methods for entering after-the-fact payroll in Write-Up. Need to be recorded accurately for accounting records and payroll reports.Payroll checks that have already been issued.Customer and job-related time can be challenging, but TSheets employees can track time to a specific customer or job. Time can either be tracked and approved in QuickBooks Online or inside TSheets, making it easy to run payroll. With a few steps, TSheets timesheets and time-related job time can be imported directly to QuickBooks Online Payroll. TSheets can schedule employee jobs or shifts, send out alerts to employees, and track time through a mobile app or browser.

With an active QuickBooks Online Payroll Premium or Elite subscription, TSheets can be accessed and launched directly from inside QuickBooks Online. TSheets by QuickBooks is a time tracking App that can be integrated with QuickBooks Online Payroll or used as a standalone product. This article is focused on TSheets and QuickBooks Online Payroll.

QUICKBOOKS ACCOUNTANT ONLINE PAYROLL LOGIN SERIES

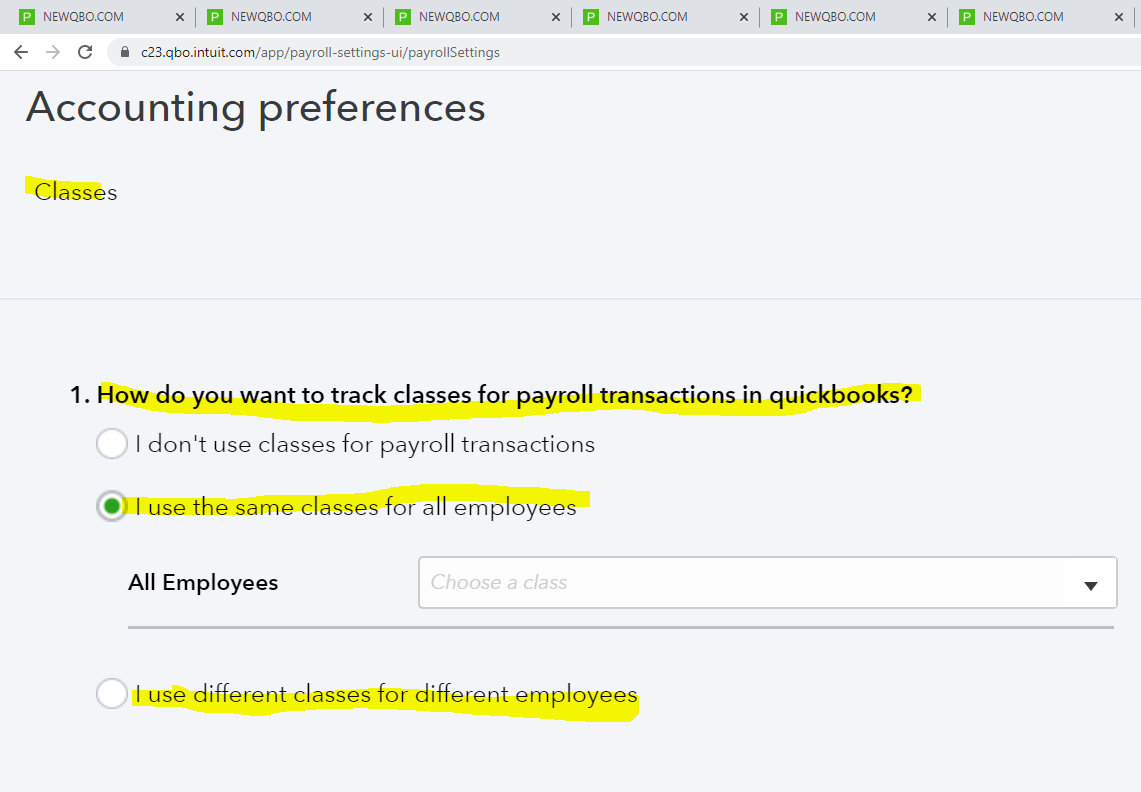

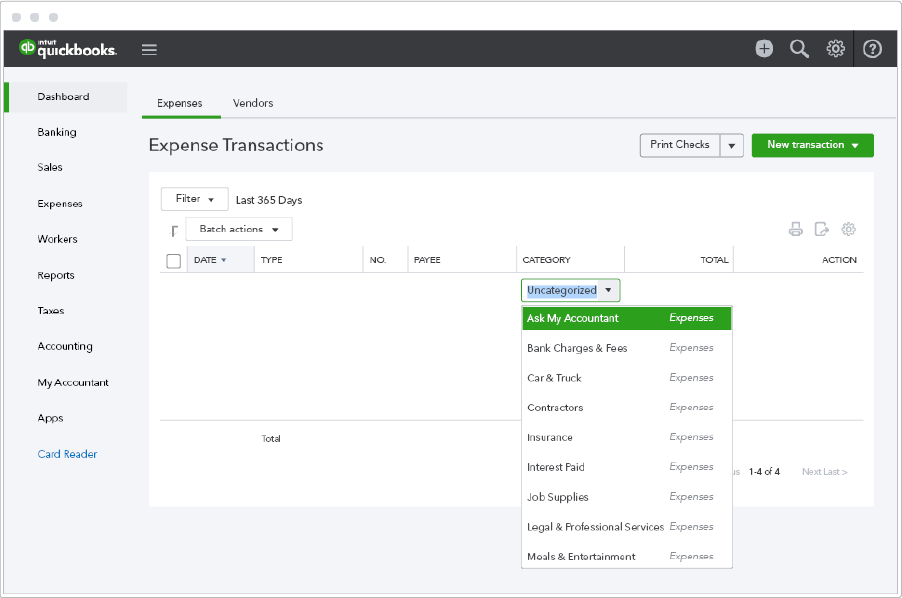

In our prior installments of this series we covered the ' basics of what you need to know', and ' essential steps in set-up'. To keep you informed, this payroll series will guide you through steps for setting up and configuring your payroll account to meet the needs of your clients' business. QuickBooks Online Payroll has launched three new payroll subscriptions: Core, Premium and Elite.

0 kommentar(er)

0 kommentar(er)